Each week, The Pulse provides insight into the buying, sourcing and brand-loyalty habits of counter professionals and professional technicians. This week, using data from Industrial Marketing Research’s (IMR) recent Installer Survey, we look at the frequency with which techs get to use their first choice of brands when selecting parts for repair jobs.

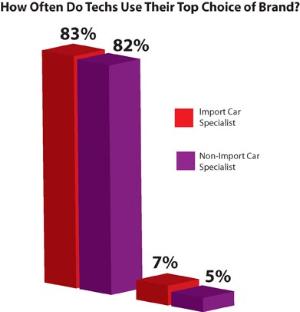

In its recent Installer Survey, IMR asked technicians how many times out of 10 they use their first choice of brand for repairs – asking them to select from an extensive list of parts, including everything from spark plugs and brake cylinders to mufflers, batteries and antifreeze. In response, 82 percent of technicians said they get their first choice every time. That number increased only slightly for import car repair specialists, 83 percent of whom cited they use their first choice of brand 10 times out of 10.

The survey, which included responses from technicians working for general repair shops, tire dealers, quick lubes, muffler specialists and gasoline service stations, found that 7 percent of import car repair specialists and 5 percent of non-import car repair specialists got their top choice of brand only 50 percent of the time, on some occasions less.

For more information on IMR and its research capabilities, visit IMR at http://www.industrialmr.com or call 800-654-1079.