LS Group, one of South Korea’s largest diversified corporations, and KKR, a leading global investment firm, have announced the signing of a definitive agreement under which KKR will become joint partners with LS in LS Automotive (LSA), an electrical auto parts maker for the global automotive industry. Under the partnership, KKR will additionally acquire LS Group affiliate LS Mtron’s copper foil and flexible copper clad laminate (CF/FCCL) business.

LS Group, one of South Korea’s largest diversified corporations, and KKR, a leading global investment firm, have announced the signing of a definitive agreement under which KKR will become joint partners with LS in LS Automotive (LSA), an electrical auto parts maker for the global automotive industry. Under the partnership, KKR will additionally acquire LS Group affiliate LS Mtron’s copper foil and flexible copper clad laminate (CF/FCCL) business.

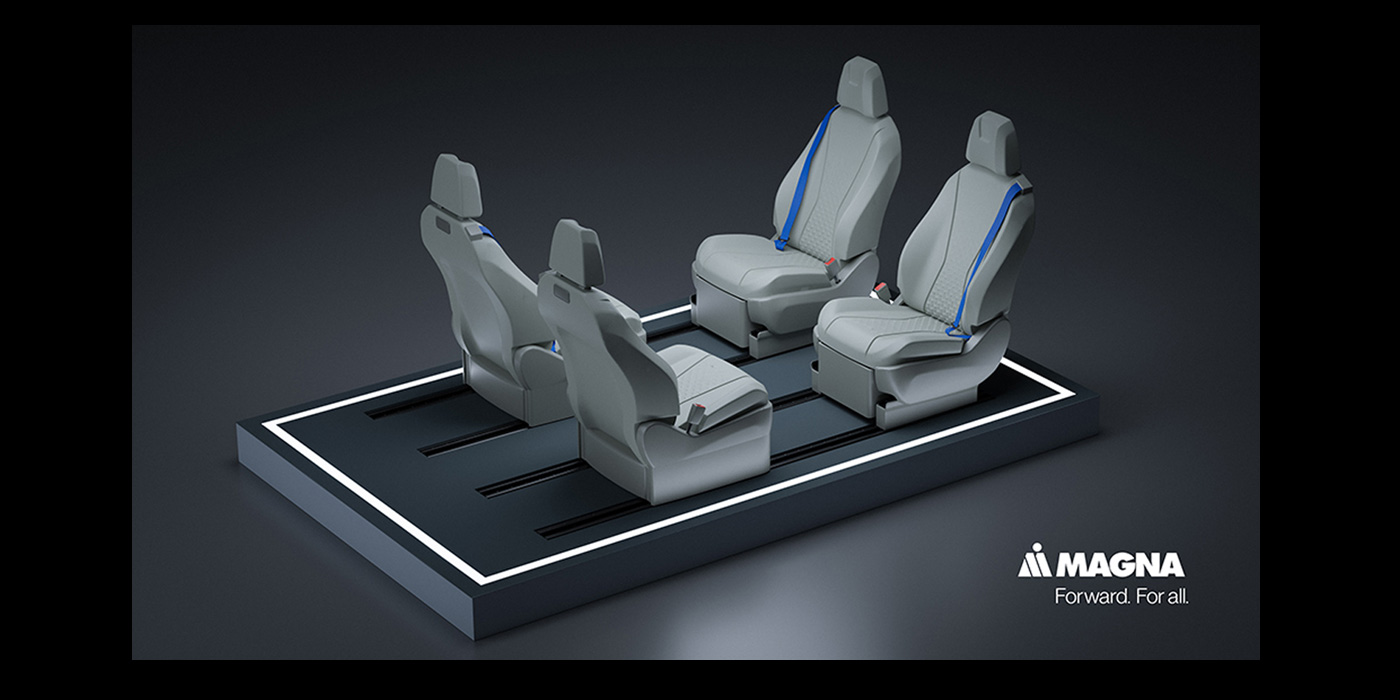

Established in 1973, LSA is a leading auto parts company in South Korea that has successfully established globally competitive positions in high-growth auto component segments including switches, interior lamps and human machine interface (HMI) systems, and electrical and electronics components such as power seat modules, electrical control units, sensors and relays. LSA is the top Tier 1 supplier of HMI components to Hyundai Kia Motors, as well as major global OEMs in the U.S. and Japan, and leading local OEMs in China and India.

Under the terms of the agreement, an affiliate of KKR and LS will together invest to create a new joint venture holding company (LSA JV) and acquire the business of LSA. LS will maintain the control of the LSA JV, owning 53 percent of the LSA JV’s voting shares and the LSA JV will remain as an affiliate of LS Group. KKR will own 47 percent of the LSA JV’s voting shares. KKR’s investment implies a combined enterprise value of the LSA and the CF/FCCL business of approximately KRW1.05 trillion (approximately $923.6 million USD).

The CF/FCCL business manufactures and sells copper foils for large capacity lithium-ion batteries for primarily electric vehicle (EV) applications. The copper foil business for EV battery applications is expected to be among the fastest-growing segments of the auto industry due to rising demand for environmentally friendlier transportation, according to the company. LSM’s EV copper foil business supplies global EV battery leaders including LG Chemical and major battery manufacturers in Japan and China.

Joon-woo Lee, senior vice president of LS Corp., said, “This partnership provides a terrific opportunity for LS Group, as a large, Korean conglomerate, to align and strengthen our focus on our core businesses. We are very pleased to enter into a partnership with KKR, a global investment firm with significant industry and operational experience, and work alongside the team to achieve growth in the future.”

Hyoung Seok Lim, managing director at KKR, and Chung Ho Park, director at KKR, said, “We are very excited to partner with LS Group and the management teams and employees of LSA and the CF/FCCL business to support their innovation and growth as the automotive industry continues to evolve rapidly and the adoption of electric vehicles expands quickly. We look forward to supporting the management teams by leveraging our international network and industry expertise to enhance the business’ operations and success beyond South Korea and China.”

KKR has maintained a strong track record of investing in South Korea from its pan-regional private equity funds since 2009 and has since invested or committed approximately US$800 million in the market. KKR has strengthened its commitment to South Korea in recent years to provide strong companies with the financial and operational resources to achieve growth and improve productivity.

KKR will make its proposed investment from its $9.3 billion USD Asian Fund III. The transaction is subject to customary approvals. Further details of the transaction were not disclosed.